[ad_1]

Rupak Ghose is an adviser to fintech businesses and a former financials study analyst.

When I joined Credit history Suisse To start with Boston in the summer of 1999 I knew wherever the action was — equity investigate. Sure, genuinely.

There was legendary telecoms analyst Jack Grubman at Salomon and Internet analysts Mary Meeker at Morgan Stanley and Henry Blodget at Merrill Lynch, every feted by the media and taking home tens of tens of millions of dollars a year. They ended up the current market gods, not the traders or the buyside. I was therefore thrilled to turn into a media equity research analyst at CSFB.

As the dotcom bubble was raging, the cowboys at CSFB went big on tech by using the services of Frank Quattrone and his merry band. It was seen as a house run to seek the services of this kind of a enormous profits generator. CSFB gave Quattrone the autonomy he craved — like getting the stock exploration analysts report into him.

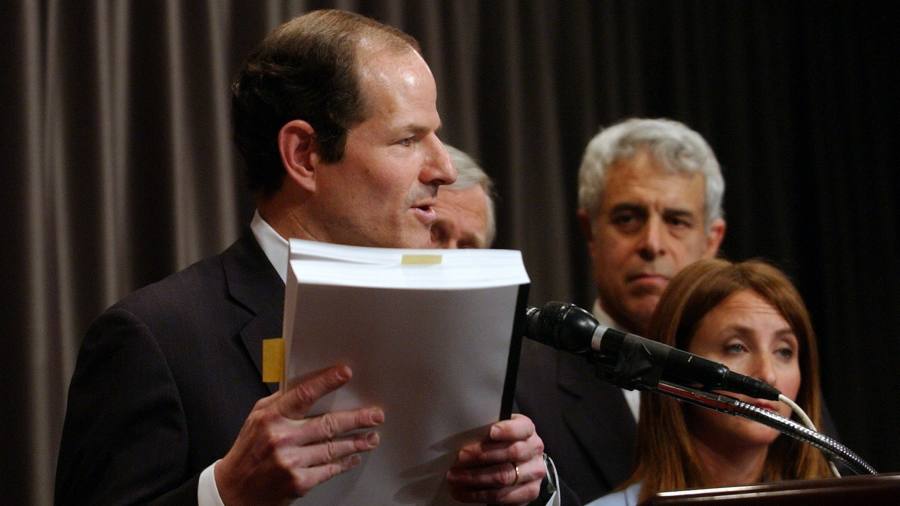

Two many years on from the Eliot Spitzer settlement that shook up the expense exploration organization, there are four reasons why it is continue to shrivelling in dimension and believability: declining details advantage, new competitors, margin pressure in secondary cash equities and a shrinking consumer foundation.

Let’s start with a declining details gain. In the motion picture Wall Road, the corporate raider Gordon Gekko states: “Come on, notify me something I never know. It is my birthday, pal, surprise me.” Bud Fox replies with insider info about a lawsuit at the airline in which his father functions. The RegFD disclosure requirements in 2000 started a push to prevent selective data dissemination by providers, and compliance on the sellside has been tightened substantially because then.

Administration groups are a lot more thorough what they say, and entry to them is far more minimal than back again then. The declining affect of the sellside means the days of CFOs chasing analysts for their time are very long absent. This creates an uncomfortable opposition amongst analysts to get into the excellent textbooks of the companies they cover with softball questions and statements on meeting phone calls like “Terrific quarter, men!”

Downgrade a stock to ‘sell’ and the expense bankers could not be ready to get you fired (at minimum not instantly), but you are probably to shed management entry. That gets you to the exact same remaining place of the dole queue, albeit a lot more little by little than in the past.

That’s due to the fact these times a big component of the price proposition of analysts is taking groups of traders on roadshows to pay a visit to non-public and community providers, or entry to their get hold of foundation of gurus. But firms have been expanding their trader relations groups to choose about administration roadshows on their own, and in age of unbundled research, why shell out a fortune on sellside investigate when you can just tap one of many pro networks?

Even so, technologies, not regulation, is what has flattened the entire world of research. Sellside analysts — continuously staying monitored by an military in compliance departments — are shockingly bad at wading through the on the internet noise to extract relevant alerts on their shares.

With so considerably facts from businesses, pro examination and media material circulating no cost on social media, the bar that sellside content ought to obvious to cost is significantly larger. The proliferation of weblogs from equally amateurs and skilled former sellside and buyside strategists at a lot lessen price tag factors is a further deflationary drag on exploration investing.

As for the sellside’s continual absence of detrimental scores, committed short advertising exploration corporations this kind of as Muddy Waters and Hindenburg have jumped into the breach. Some media outlets that are hoping to safeguard their moats have expanded appreciably in investigative journalism (an FT subscription to go through Dan McCrum’s Wirecard reporting was far more cost-effective and worthwhile than the exploration reviews the sellside produced).

3rd is the evaporating profitability of sellside hard cash equities enterprises. Most revenues and income are produced by equity derivatives and prime brokerage. Funds fairness fee charges have collapsed in fairness trading, and sector share ceded to high-frequency investing firms. Algos never need to have to talk to equity investigation analysts.

Fourth (and intertwined with all the previously mentioned components) is the progressively compact consumer base for sellside fairness investigate.

Only a decade ago, huge asset managers like Fidelity would be at the top rated of investigate consumer lists, generating large quantities of revenues by way of investing commissions explicitly tied to exploration content. But the range of significant, lengthy-only asset administrators that take in and shell out for sellside articles has collapsed, making analysts progressively dependent on a little quantity of multi-method hedge funds.

The irony of all these developments is that equity research analysts now do the job much more for financial investment banking than ever before. Even though payments are now oblique and spread over a lot of elements of the lender, the proportion of a cash equity profits and exploration office value base that is lined by commissions from the buyside is lessen than ever right before.

And regardless of what occurs on the regulatory entrance, it’s hard to see how something will meaningfully modify. The era of star analysts died many years ago, and isn’t coming again.

[ad_2]

Source url