[ad_1]

What’s in a identify? Would a bundle of money securities that depict the fractional possession of some companies by any other moniker execute as sweetly? Apparently not.

Individuals increasingly categorise equities not just by sector or country, but according to “elements” — generally what inventory market place design and style they are, and what drives them.

For example, substantial elements (nevertheless not all) of the technological know-how environment are “growth” shares, in that they tend to be much more high-priced, faster-expanding businesses. Electrical power companies, industrial conglomerates and car or truck suppliers are commonly “value” stocks mainly because they are less expensive.

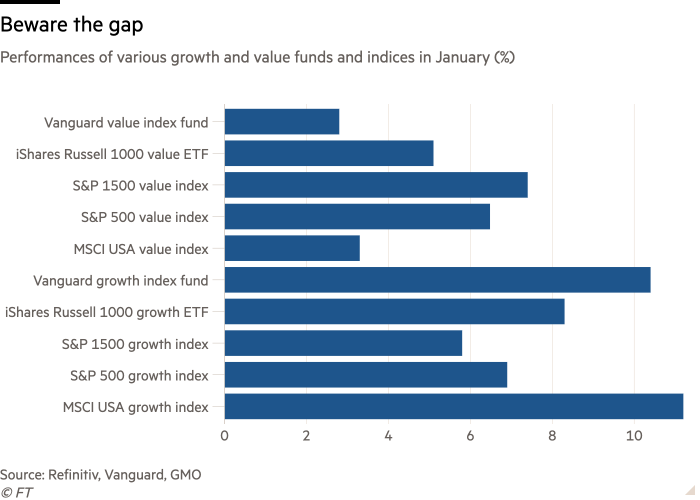

On the other hand, how specifically you measure these things can from time to time have a big result. Listed here are the relative January performances of many US price and growth indices and index-monitoring funds.

Pursuing Vanguard’s way of slicing and dicing inventory sector things (they use CRSP indices), advancement outperformed value by 7.6 share factors very last month, although MSCI’s US price and development indices also diverged markedly (3.3 for every cent vs 11.2 per cent respectively). In distinction, the price and development variations of the blue-chip S&P 500 done fairly likewise in January.

Probably most eye-catchingly, if 1 utilizes S&P’s broader inventory current market benchmark — the S&P 1500 Composite index — then worth stocks basically defeat development by 1.6 proportion points.

Discrepancies take place, but January’s divergences seems unusually sharp. Here’s GMO’s asset allocation workforce — which alerted FTAV to the problem — on the topic:

• Just after a bruising 2022 for equities globally, Worth shares in the U.S. have come to be interesting in an complete sense and deserving of inclusion in one’s portfolio. But the vast array in returns for various Price implementations in January 2023 raises the concern, What are “Value” shares?

• At GMO, we determine the Worth universe as these shares that trade at a discounted relative to the current market centered on our assessment of fundamental company fundamentals. When estimating company value, we

— regulate described (GAAP) data for metrics like guide worth and earnings by capitalizing intangible property and accounting for the effects of share buybacks,

— understand that bigger-excellent and more quickly-increasing firms deserve a valuation high quality, and

— employ numerous valuation products to make certain a strong assessment of general attractiveness.• Index vendors just take extremely distinctive methods, not just relative to GMO’s tactic but also relative to each other. The effectiveness of a variety of indices’ Value implementations in January 2023 makes this abundantly very clear. Worth possibly outperformed by 1.6% or underperformed by 7.6%, depending on which index you follow.

• Or, have a appear at the rate-to-earnings ratios and return-on-fairness amounts. If you are getting Benefit passively, you could be shelling out 21x for a 19.5% ROE group of shares or 25x for a 13% ROE portfolio.

We took out GMO’s plug for a single of its possess benefit money at the end, but for reference it was up 8 per cent in January.

All in all, it is a superior reminder that even honest efforts to try out to impose some rigour and purchase to the chaos of marketplaces generally fails simply because human-produced frameworks are inherently subjective as very well.

Does that necessarily mean that things are useless? No. As the statistician George Box once quipped, “all designs are improper, but some are useful”. The variable framework is an imperfect, messy but nevertheless beneficial way of on the lookout at marketplaces.

[ad_2]

Supply link