[ad_1]

Performing from property through the pandemic sparked domestic migration with some employees homing in on states with no or low-earnings taxes.

But that does not necessarily mean they did not experience a tax monthly bill elsewhere.

If states really do not tax profits, they however require to generate profits and that is ordinarily mirrored in property taxes or sales tax.

“No-earnings-tax states, on average, have property taxes 3% to 6% previously mentioned those people in earnings-tax states and product sales taxes 15% to 20% above individuals in cash flow-tax states,” the Middle on Price range and Policy Priorities (CBPP) advised Yahoo Finance.

If you are thinking about shifting to yet another state to decrease your tax liability, it is vital to comprehend that though no or very low revenue taxes might be a draw, residence and income taxes need to be part of the equation, as well.

10 states with best and most affordable revenue tax premiums

Unique revenue taxes account for 40% of profits for the states that tax money, according to the Tax Basis.

Point out profits tax can selection from as reduced as 2.5% in Arizona to a large of 13.3% in California. California, Massachusetts, New Jersey, New York and Washington, D.C., also have a so-referred to as “millionaire tax” surcharge, for taxpayers in the optimum earnings brackets, with a million or much more in earnings. In 2021, New York enacted an further leading fee of 10.9% for these with profits exceeding $25 million.

A different thing to consider is the tax composition your point out uses. Does it apply a flat fee to all incomes or a graduated price that increases with income?

Like the federal authorities, some states reduce the tax load for inhabitants by offering exemptions and deductions or utilizing particular tax brackets, so married filers can steer clear of a “marriage penalty” that typically happens if both equally spouses function. Other states tie any regular deductions or exemptions to the federal tax code.

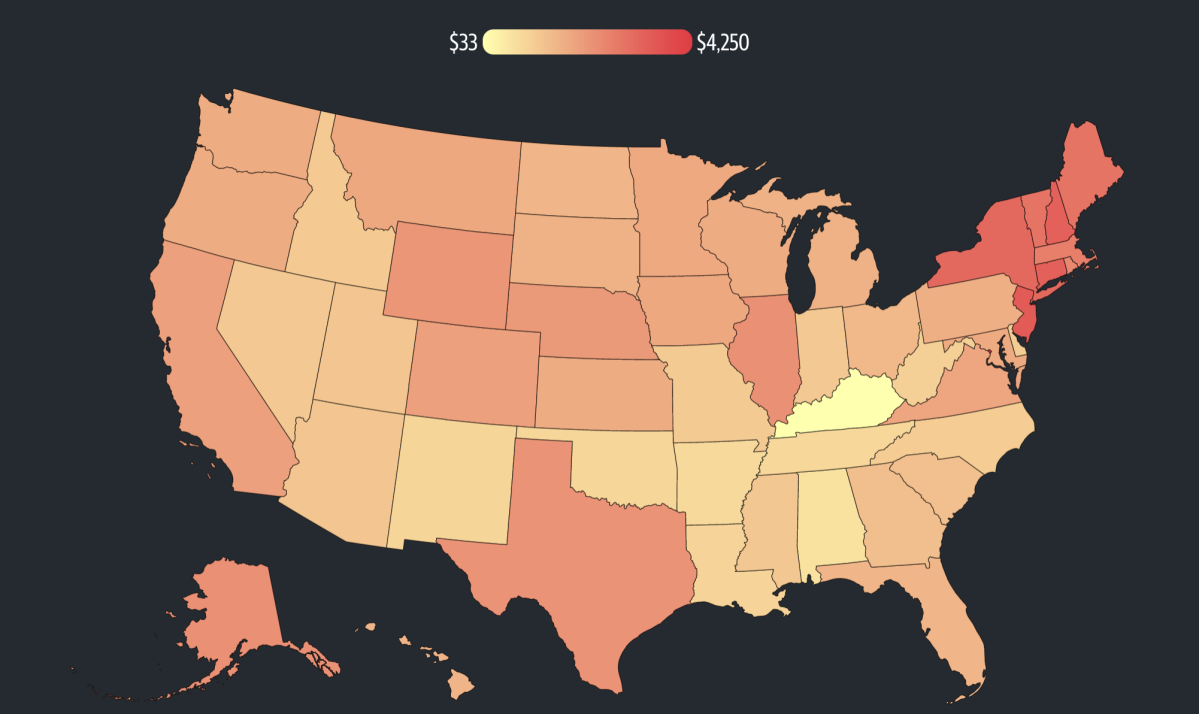

Highest and cheapest assets taxes

Property taxes make up 31.1% of state tax collections and 71.7% of neighborhood tax collections, according to the Tax Foundation.

Even however Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming have no income tax, investigate from the Heart on Finances and Policy Priorities displays that residence and income taxes are generally 6% bigger to make up for no revenue from revenue taxes.

Alaska ranks the 10th most highly-priced condition for assets taxes and Texas is the 12th most pricey, in accordance to knowledge from the Tax Basis.

Residence taxes and cities

Even if your point out might have small residence taxes, your place inside of that point out may perhaps have greater residence taxes.

The pandemic housing increase and the potential to perform remotely spurred domestic migration to regions expanding household costs and values. Home owners in those people localities most possible will see an uptick in regional assets taxes.

For illustration, though Texas has no money tax, Austin has the fifth-major assets tax in the U.S. with property owners spending a median of $5,751. Dallas ranked 13th and Houston rated 16th amid towns with the optimum home taxes, in accordance to a research by LendingTree.

Best and lowest sales tax

Income tax is yet another way states create profits.

Forty-5 states have a sales tax, furthermore the District of Columbia, with 38 states letting nearby sales tax, in accordance to a report by the Tax Foundation.

Alaska, Delaware, Montana, New Hampshire, and Oregon do not have point out sales tax. Even though Alaska does not have a state revenue tax, it permits localities to charge a community sales tax.

Even although a point out might have a small money tax price, the sales tax might actually be high. For instance, Louisiana has among the the least expensive profits and house taxes, but it has the maximum merged state and nearby profits tax of 9.55%.

Similarly, Tennessee has no state cash flow tax, is in the most affordable 10 states for home tax, but has the next-highest blended revenue tax rate at 9.548%.

Arkansas, Alabama, and Oklahoma have some of the cheapest residence tax rates, but they are amid the leading 10 states with the best put together profits tax rates.

Ronda is a own finance senior reporter for Yahoo Finance and lawyer with expertise in law, insurance plan, education, and government. Observe her on Twitter @writesronda

Go through the newest financial and organization news from Yahoo Finance

[ad_2]

Resource link