[ad_1]

by Calculated Threat on 6/03/2023 08:11:00 AM

The crucial report scheduled for this week is the April trade stability.

—– Monday, June 5th —–

10:00 AM: the ISM Services Index for May. The consensus is for a reading through of 52.5, up from 51.9.

—– Tuesday, June 6th —–

8:00 AM ET: CoreLogic House Cost index for April.

—– Wednesday, June 7th —–

7:00 AM ET: The Property finance loan Bankers Affiliation (MBA) will launch the benefits for the house loan purchase purposes index.

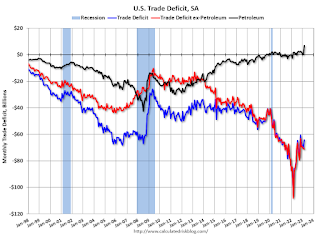

This graph exhibits the U.S. trade deficit, with and with no petroleum.

The blue line is the complete deficit, and the black line is the petroleum surplus, and the purple line is the trade deficit ex-petroleum products and solutions.

—– Thursday, June 8th —–

8:30 AM: The original weekly unemployment promises report will be introduced. The consensus is for 238 thousand original claims, up from 232 thousand final 7 days.

—– Friday, June 9th —–

No key financial releases scheduled.

The consensus is the trade deficit to be $75.4 billion. The U.S. trade deficit was at $64.2 Billion in March.

—– Thursday, June 8th —–

8:30 AM: The original weekly unemployment promises report will be introduced. The consensus is for 238 thousand original claims, up from 232 thousand final 7 days.

12:00 PM: Q1 Stream of Money Accounts of the United States from the Federal Reserve.

—– Friday, June 9th —–

No key financial releases scheduled.

[ad_2]

Supply url

Program for Week of June 4, 2023