[ad_1]

by Calculated Danger on 4/28/2023 01:41:00 PM

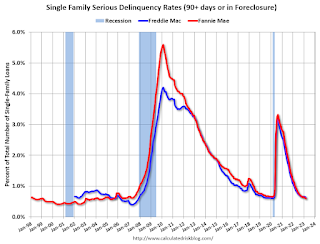

Fannie Mae reported that the Solitary-Household Serious Delinquency reduced to .59% in March from .62% in February. The severe delinquency level is down from 1.01% in March 2022. This is down below the pre-pandemic levels.

These are home loan loans that are “three regular payments or more earlier because of or in foreclosure”.

The Fannie Mae critical delinquency price peaked in February 2010 at 5.59% subsequent the housing bubble and peaked at 3.32% in August 2020 in the course of the pandemic.

By classic, for loans designed in 2004 or before (1% of portfolio), 1.93% are severely delinquent (down from 2.04% in February).

For financial loans designed in 2005 by way of 2008 (1% of portfolio), 3.11% are severely delinquent (down from 3.31%),

Home loans in forbearance were counted as delinquent in this monthly report, but they were being not reported to the credit score bureaus.

Freddie Mac documented earlier.

[ad_2]

Resource connection