[ad_1]

Authored by Alex Kimani by means of OilPrice.com,

-

Actual physical nickel marketplaces have turn into oversupplied in 2023.

-

A new wave of offer from Indonesia has set charges beneath pressure.

-

Worldwide Nickel Examine Group: the nickel industry will encounter a provide-demand surplus of 239,000 tonnes.

Previous year, the nickel markets came into the limelight courtesy of the historic nickel quick squeeze that sent nickel prices soaring to an astonishing $100,000 for every tonne.

The significant surge doubled the earlier all-time significant over the class of a person early morning and plunged the London Metal Exchange into an existential disaster. And, just like the popular copper squeeze of extra than a century ago, the nickel market place snafu was mainly linked to tremendous short positions held by a single man: Chinese metal trader Xiang Guangda, the founder of China-based Tsingshan Holding, the world’s largest nickel producer.

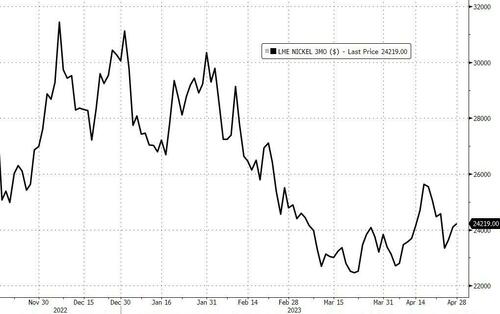

And now the exact opposite is going on in the nickel markets, only that this time close to it is the actual physical nickel marketplaces and not nickel futures or a one trader that are to blame for the crash. Nickel charges have crashed in the recent calendar year, slipping 21% in the 12 months-to-day to $23,300 for each tonne thanks to a significant source glut as Indonesian output proceeds to outpace international need. In accordance to the Global Nickel Research Group (INSG), the nickel industry will experience a offer-desire surplus of 239,000 tonnes, the major in at the very least a ten years and more than double past year’s excessive of 105,000 tonnes. That revised figure is also way bigger than the group’s last forecast in Oct when it expected the surplus to clock in at 171,000 tonnes in 2023.

While world nickel demand is on observe to sign up balanced 6.1% progress in 2023, matching last year’s demand from customers progress, it won’t be anywhere in the vicinity of ample to take up the wave of new creation coming out of Indonesia.

Spot Nickel Costs (USD/metric ton)

Supply: Bloomberg

It is rather shocking that nickel need even rose at all in 2022 considering the Earth Stainless Affiliation noted that stainless steel output fell 5.2% all through the calendar year. The stainless metal market is the greatest consumer of nickel, gobbling up 75% of world wide production in a typical yr. China is largely to blame for the weakening nickel desire just after the removal of subsidies and the shift toward non-nickel chemistries.

That stated, EVs are rapidly turning out to be an essential nickel purchaser. In accordance to exploration property Adamas Intelligence, 17,137 tonnes of nickel had been deployed in EV batteries in the thirty day period of February by itself, great for 19% thirty day period-on-thirty day period and 47% Y/Y growth.

Despite the fact that the EV sector is developing at a brisk clip, it will nonetheless struggle to soak up surging creation from the likes of Indonesia. INSG’s most the latest monthly bulletin has claimed that the country’s nickel mine output grew a huge 48% to 1.58 million tonnes in 2022 and by another 44% in the very first two months of the recent 12 months. Indonesia slapped a entire ban on the export of ore in 2020, indicating that all that mine output is now remaining converted to nickel items.

But not all nickel grades are experiencing a supply glut.

Certainly, while the provide of Course II nickel–that contains less than 99.8% nickel–proceeds to grow swiftly, supply of Course I nickel–the grade traded on the LME–has declined 28% so considerably this calendar year to 40,032 tonnes, the most affordable amount due to the fact 2007. Shanghai registered nickel shares are even lower at just 1,496 tonnes many thanks to China’s imports of refined nickel remaining increasingly replaced with intermediate merchandise heading for the EV sector. The contango throughout the benchmark funds-to-a few-months unfold has contracted from around $200 per tonne in early April to just $12 at the moment, suggesting traders are developing additional bearish about foreseeable future nickel price ranges.

China Nickel pig iron 8-12% (Yuan / metric tonne)

Resource: Bloomberg

Commodities Pullback

But the nickel markets are barely alone. After a raging bull industry in 2022, international commodity marketplaces have been pulling again in 2023 with the World Bank predicting that world commodity costs will decline this yr at the speediest clip due to the fact COVID-19 pandemic struck in late 2019.

In accordance to the bank, total commodity charges will agreement 21% in 2023 relative to 2022, with power price ranges projected to slide 26%. Brent crude oil is envisioned to typical $84 a barrel this yr, down 16% Y/Y, while U.S. and European pure-gas price ranges are forecast to be minimize in half. Meanwhile, coal rates are anticipated to drop 42% in 2023 although fertilizer costs are also projected to decrease 37%, marking the largest once-a-year fall considering that 1976. Nevertheless, fertilizer rates are even now shut to their modern superior observed throughout the 2008-09 food stuff crisis.

Sadly, the World Financial institution claims that falling meals costs will convey little aid to the additional than 350 million people struggling with food insecurity across the world owing to the fact that despite the fact that food price ranges are expected to tumble 8% in the existing yr, they will however be at the 2nd-greatest amount due to the fact 1975.

Loading…

[ad_2]

Source website link