[ad_1]

“Our cycle indicators signal a default wave is imminent,” says Deutsche Financial institution in its yearly default analyze:

The tightest Fed and ECB plan in 15 decades is functioning into elevated corporate leverage designed upon stretched earnings margins. This is particularly accurate in the leveraged personal loan sector, where LBO leverage was juiced larger 12 months right after year (following year) by zero costs and central bank QE. And though maturity partitions were being straight away termed out in the aftermath of the Covid pandemic, limited money situations considering the fact that 2022 have altered the story

Past year’s report was all about how greater inflation would conclude the 20-year supercycle of minimal company defaults. In this year’s version, Deutsche strategist Jim Reid and staff sketch out the late-cycle hangover where by credit rating losses increase steadily as a result of 2023, adopted by a additional sharp deterioration in 2024 as the US enters a economic downturn:

Deutsche’s projections are for the default charges to peak in Q4 2024. The products “merely presume a return of the Increase-Bust cycle, not a GFC-model banking procedure collapse”:

Europe does a little bit superior than the US since of more fiscal aid and less techno-froth.

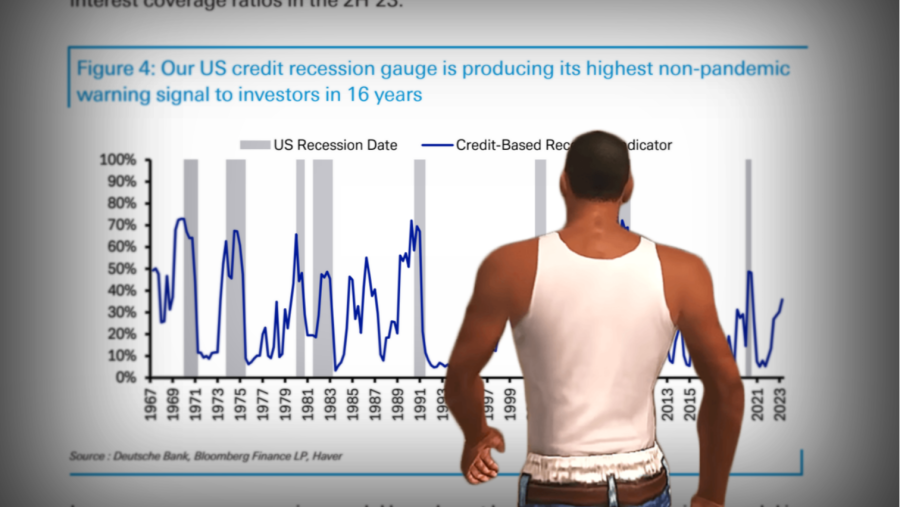

The recession indicator is flashing due to the fact amongst non-fiscal corporates, leverage is rising and curiosity protection is slipping, when lender loan delinquencies are up and loan providers are tightening conditions. These are all established and dependable recession signals, so once Fed hikes function their way by way of to corporate desire fee protection ratios afterwards this calendar year it’s foolish to believe any other consequence than the norm:

Will the Fed trip to the rescue all over again? No, Deutsche states, mainly because the coming US recession will be extra like the dotcom bubble than the GFC:

Company leverage is elevated. And worldwide credit markets derive more of their profits from production and the sale of physical products than the genuine economic climate at huge. Heading ahead, corporates will possible lose pricing electric power on their sale of bodily merchandise, due to large stock builds and a submit Covid need shift from products to products and services.

But labour prices are very likely to continue being sticky, due to the fact of a shrinking operating-age inhabitants and a desire for shoppers to recoup nearly 2 several years of detrimental authentic wage advancement. This circumstance will 1) force earnings margins & 2) prevent the Fed/ECB from riding to the rescue with open up-ended QE (provided continue to sticky wage costs). Consequently, a a lot more shallow nominal GDP trough + large leverage + significantly less plan assistance could lead to a sizeable decoupling in between the real financial system and the credit marketplaces for the duration of the subsequent recession.

It really is the length of the boom that can make this bust abnormal, these kinds of as with the sum of leveraged buyout credit card debt swilling all-around. The period in between 2014 and 2021 was equal to the pre-GFC buyout rush but went on for eight consecutive years, leaving at the rear of a wall of LBO financial loans to climb, Deutsche suggests:

The write-up-crisis consensus guess was to LBO corporations in non-cyclical sectors. The final result is concentration possibility. A third of US leveraged financial loans are in tech, health care and enterprise expert services, so the US will be “uniquely exposed” if non-cyclical defaults rise much more than envisioned:

What about all individuals increase-and-fake financial debt refinancings over past couple of several years? Hasn’t the can presently been kicked?

There are two considerations we have with this thesis. Initial, maturity partitions are not the main driver of defaults unsustainable cash structures are. Specially in a planet where private-equity corporations management a sizeable share of bank loan issuers, distressed exchanges are attainable right before a business has an impending maturity due. Next, 2022’s charge shock and 2023’s expansion fears have enforced persistently limited money conditions on leveraged corporates for the earlier 18 months, major to a paucity of new issuance and refinancing activity.

It is no excellent acquiring three a long time to maturity when refinancing’s shut for the foreseeable and there’s a recession on the horizon. Debt with less than a single 12 months remaining will become latest on a company’s balance sheet, which triggers the score organizations, so the runway just before traders commence to stress is 18 months at best.

For a whole lot of junk issuers, quick runways could be a challenge:

The original objective of Deutsche’s default examine collection when it was released 25 decades in the past was to estimate what company credit spreads were being demanded to compensate a client acquire-and-maintain investor for common default threat. But figuring out what is in the price is complex. This yr, of illustration, investors feel to believe the trouble will be contained.

Because the mid-2022 progress scare, approximately 10 per cent of US and European speculative-grade debt has been buying and selling below 80 cents in the greenback. But superior-produce credit score spreads for issuers have remained rather tight to financial commitment grade. Distress ratios currently point out high-produce default charges of just 3.6 for every cent in the US and 2.2 for every cent in Europe by the third quarter 2024, Deutsche estimates its forecasts simply call for 8.4 for every cent and 4.4 per cent respectively.

And for substantial-generate distressed financial debt, it’s all about the real estate:

This year’s analyze finds that all grades can in all probability be trusted to outperform federal government bonds above the very long expression, nevertheless single-B and CCC will be in difficulty if the foundation scenario for defaults proves optimistic. The problem is the brief phrase, states Deutsche simply because in a recession, there are a lot of approaches for stuff to get a ton cheaper.

[ad_2]

Resource hyperlink