[ad_1]

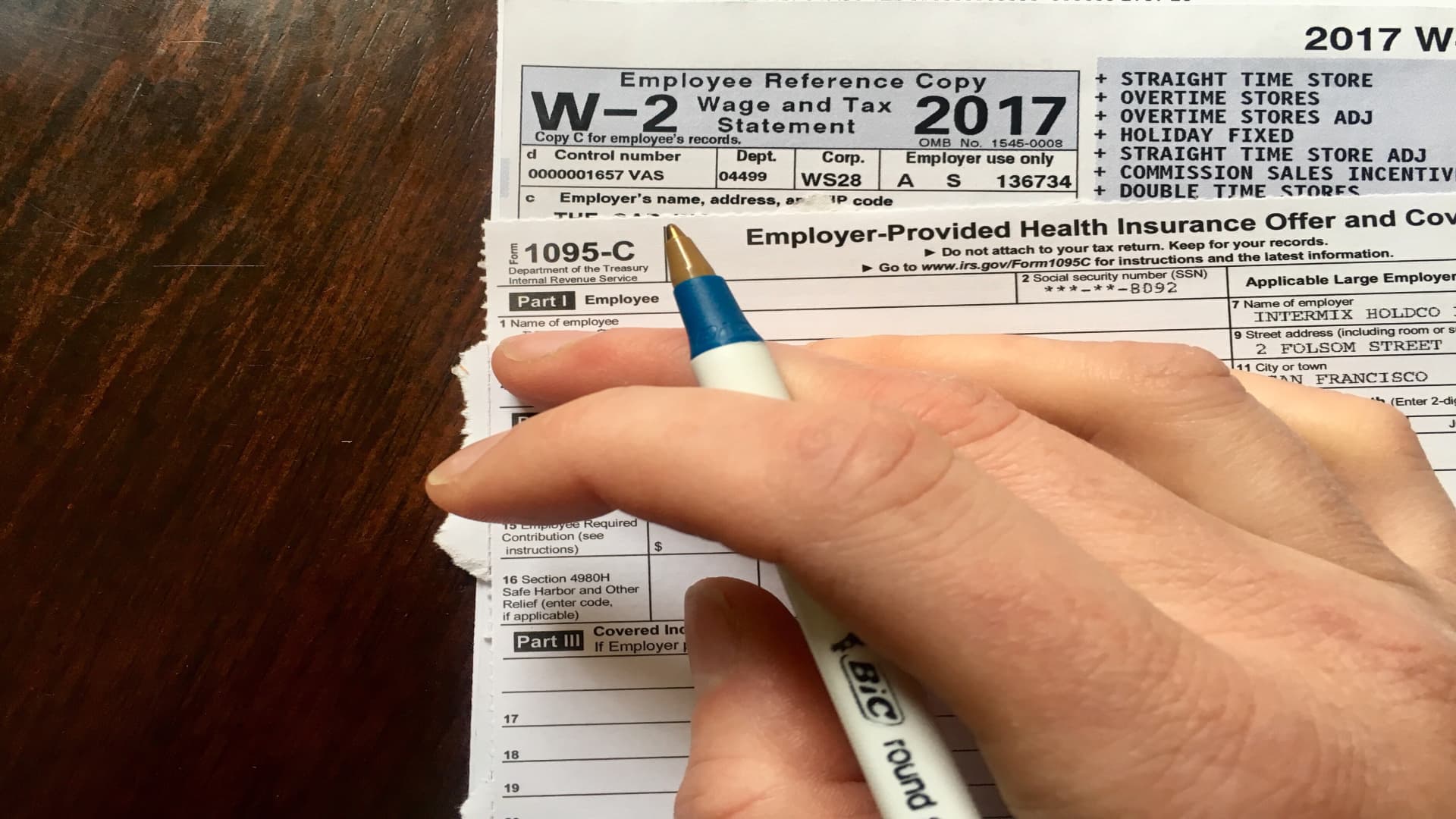

Tax period is on us, and alongside with it arrives the ensuing bout of paranoia about the dreaded IRS audit.

But, statistically speaking, acquiring audited is unlikely for most American taxpayers. In 2022, the IRS audited 3.8 out of every 1,000 money tax returns.

Audit prices have been on the drop due to the fact 2010. Throughout all revenue brackets, the audit rate lowered to .25% in 2019, down from .9% in 2010.

The wealthiest taxpayers seasoned the greatest per cent transform about that period. In 2019, a small additional than 2% of People in america earning far more than $5 million for every year had their taxes audited. Which is down from 16% in 2010, in accordance to a report from the Governing administration Accountability Business office.

“For taxpayers earning in excess of $1 million, there has been considerable reduction in audit premiums, but they are nonetheless audited a lot more often than taxpayers earning under $200,000,” stated Alex Muresianu, a policy analyst at the Tax Foundation.

The GAO report concludes that a drop in IRS funding was a major contributor to the decrease in audits. Funding for the agency lowered by a lot more than 20% amongst 2010 by means of 2019 when altered for inflation.

“The IRS, like most areas of governing administration, relies on the annual appropriations process,” said Mark Everson, a former IRS commissioner and existing vice chairman at Alliantgroup. “The trouble is that the Congress will not do a very good career of funding the govt.”

The major slash in that has been in enforcement — and especially in their most very qualified agents who do the audits.

Janet Holtzblatt

senior fellow at the Urban-Brookings Tax Coverage Heart

About 70% of the IRS’s all round price range is put in on labor. As a result of the expending cuts, the IRS personnel was reduced by 22%.

“The largest reduce in that has been in enforcement — and specially in their most highly qualified brokers who do the audits and who also do collections,” said Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center. “And all those are the really type of brokers that do the most innovative, most tough returns.”

“This is highly complex get the job done and you require expertise,” Everson said. “An individual who’s a few years out of college or university just isn’t heading to be carrying out the technological function on the ExxonMobil tax return.

“It can take a even though to get that level of understanding and sophistication,” he additional.

A turnaround commenced amid the pandemic

The pandemic marked a turning stage of types for the IRS. In 2020 and 2021, the IRS gained supplemental funding from Congress thanks to the pandemic, which led to a slight bump in comprehensive-time work.

In August 2022, President Joe Biden signed the Inflation Reduction Act into law, which set aside approximately $80 billion for the IRS to be made use of over the following 10 several years.

“It can be an unusually big amount for the IRS,” Everson reported. But “if you assess it to the Navy or the Division of Overall health and Human Companies, no, it is not a substantial sum of income — so it can be all relative.”

Nearly $46 billion will be applied for tax enforcement, much more than $25 billion for procedure support, additional than $3 billion for taxpayer products and services, just about $5 billion for know-how modernization and a fifty percent billion pounds on provisions these as renewable power tax credits.

Considering the fact that receiving the supplemental funding, the IRS programs to employ 10,000 personnel, a move that may ramp up audit activities. The Congressional Finances Office estimates that the supplemental funding will boost authorities revenues by approximately $200 billion above the 10-year period of time.

Watch the online video previously mentioned to find out a lot more about how the IRS works and how a decade of spending plan cuts has impacted audit fees.

[ad_2]

Source connection