[ad_1]

Yesterday mainFT released a magazine piece I wrote on the actual Bloomberg LP — the remarkably resilient and wildly cultish info empire. Since I cheated on FTAV I assumed I’d make up for it by expanding a minor on some areas in this article now.

Reading through the reader comments on a time-consuming massive piece usually outcomes in an odd combine of edification and validation, anger and disgrace, and disappointment and regret. The latter normally dominates, simply because even with 4,000-as well as phrases there are hard conclusions to make on what to include things like and what to slash. The first draft was around 6,000 text, and even that felt lean. It could quickly have been two times that.

Bloomberg LP is a truly fascinating firm, both for the reason that of its achievements and neuroses. (Potentially notably since of its neuroses.) It’s not very as cultish as, say, Bridgewater, but there’s a incredibly clear tradition about the spot that even seems to seeps into the fishtanks. Bryce employed to function the graveyard change and every single early morning viewed the “Aquarium Attendants” scoop out fish that experienced died fighting right away.

For instance, I tried to stay clear of writing about the media aspect as much as feasible, as one particular of my central arguments is that Bloomberg LP is wrongly conflated with just a person of its (scaled-down) divisions. To put this in context, the B-PIPE enterprise that funnels data direct to customers outside the house the terminal ecosystem apparently generates about 4 moments the revenues of the entire media division. The core terminal company is ca 18x greater.

This is not to denigrate Bloomberg News’ achievements (it is annoyingly fantastic and ferociously aggressive), but in the context of Bloomberg LP, it is most effective recognized as an app on the terminal. An significant a single! But nonetheless just an application. Which is why its price is tough to disaggregate from the whole. As 1 resource place it to me, no 1 buys an Iphone for the enjoy application, but you’d miss out on it if it was not there.

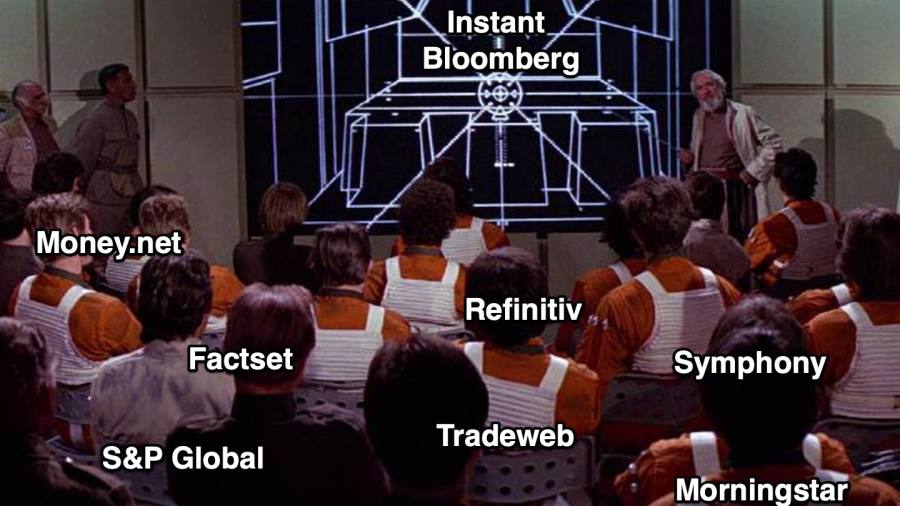

That provides me to what a lot of people today argue is the Bloomberg terminal’s not-so-secret killer app: Quick Bloomberg.

Each and every day, folks deliver an normal of about 30mn IBs around, with every thing from requests for bond estimates to discussing past night’s sporting activities benefits. About 1.4bn Bloomberg Messages (mainly its on-system emailing technique) are despatched a day on ordinary, but the genuine magic is arguably IB.

For normies, imagine Discord but for people who went to Wharton. Or as Ranjan Roy mirrored back again in 2014:

When I started in 2002, we only had Bloomberg Messaging, which allowed users to simply just static concept every other inside of the Bloomberg ecosystem. I imagine it was probably 2004 that Prompt Bloomberg was introduced and began to produce the book on product or service stickiness.

Quickly, you were being either on Bloomberg or you “didn’t exist”. It was an obnoxious, however incredibly prevalent networking apply to meet a person and as an alternative of exchanging business enterprise playing cards, you’d promise to just ‘find them on Bloomberg’. If you weren’t a subscriber it quickly impacted your believability with probable clientele. It turned an helpful rite of passage for a young trader to “get their Bloomberg”.

This produced into an odd social protocol. When you initial achieved a opportunity company call, you MSG’ed (Bloomberg Messaging) them. If both equally functions felt it was a worthwhile relationship, you’ d phase it up to IB (chat). If you grew to become organization besties, you would build a ‘recurring’ chat room, that means every single time you loaded up your Terminal the chat space would quickly open up. A recurring chat romantic relationship was not a little something you jumped correct into. It meant something.

. . . Bloomberg’s basic chat features has arrive to define Warren Buffett’s strategy of financial castles surrounded by unbreachable moats. Its ubiquity throughout the fiscal local community produced it the communications manner of preference for any big bank or fund participant. Both you were on Bloomberg, or you weren’t.

Numerous commenters argued that not highlighting the centrality of IB was a large oversight. To be honest, yes, I would have liked to dig into it effectively. But primarily since I truly feel that the dominant value of IB is a tad overstated.

Absolutely sure, it is central to the Bloomberg terminal profits pitch. In some organizations — these types of as fixed money — you may possibly as perfectly not exist if you don’t have access to IB. I’ve listened to of some financial commitment exploration consultancies that have to get a terminal simply just so they can be plugged into and chat with their largest clientele. Fairly a lot all the things else on the terminal can be located in other places, and generally significantly additional cheaply.

This was why there was so a great deal buzz around Symphony when it introduced to fantastic fanfare in 2015, many thanks to backing from big Bloomberg clients led by Goldman Sachs (which was irate about Bloomberg journalists applying personal terminal knowledge to snoop on its employees).

Symphony is now greatly utilised, with the corporation saying it has in excess of fifty percent a million buyers across far more than 1,000 finance sector firms. But I assume it is reasonable to say that it has failed to loosen the Bloomberg terminal’s grip about Wall Road despite increasing $511mn of funding, including stick to-on rounds led by the likes of Google.

In spite of Bloomberg cautiously quasi-unbundling IB a although back again — which some rivals believed would expose the relaxation of the terminal to be “a pretty high priced Facebook” for bond traders — sales have actually picked up lately.

The situation is that IB (and Bloomberg messaging) is absolutely integrated into every other function of the terminal, regardless of whether it is trade execution, chance administration or compliance. It’s like rivals wondering that by chopping down the tree they can see the wooden driving will disappear.

As Rupak Ghose pointed out in this article on AV past 12 months, “if the terminal’s knowledge and operation were weak then messaging alone would not be enough.” The truth is that there are numerous interlocking and mutually-reinforcing factors why Bloomberg stays dominant in the money and analytics world.

Just acquire the FT as an case in point. No one particular right here at any time utilizes IB, and only almost never use the messaging technique (largely to beg for aid from the Borg’s astonishingly fantastic services desk). But our beancounters reluctantly still shell out for a 50 percent-dozen or so terminals to share around the major workplaces, irrespective of outstanding and frequent strain to slice fees in the (non-BBG) media industry.

Is IB pretty significant? For absolutely sure. Is it the Demise Star’s thermal exhaust port? Lol, no.

[ad_2]

Supply backlink