[ad_1]

Authored by Simon White, Bloomberg macro strategist,

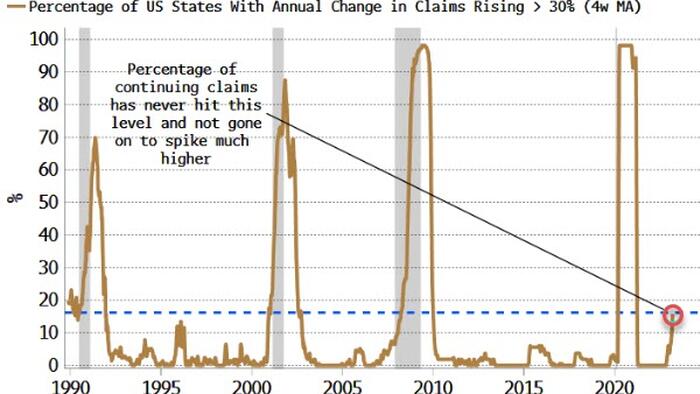

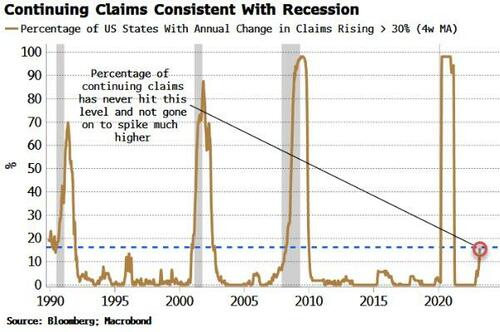

A pervasive deterioration in continuing statements facts throughout US states is consistent with a economic downturn beginning extremely soon.

Historically a economic downturn really should indicate stocks creating new lows, but this cycle is proving odd, and this should really not be taken as browse. Pretty responsible — and one very rare –technological alerts level to a extensive-expression constructive outlook for US equities.

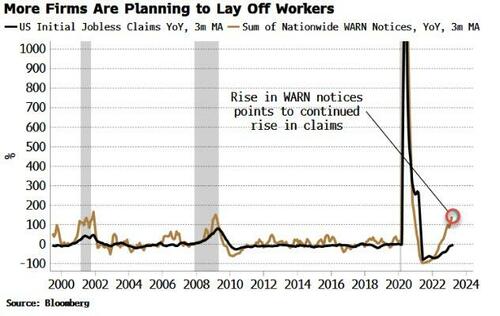

Jobless promises is one particular of the most important details factors now. Gauging when the weakening in the work current market starts to accelerate is important in discerning when the Fed will very likely lower rates. Claims are a single of most foremost of labor-market place collection, and they are large-frequency, coming out weekly.

The details is also unveiled by state. Recessions are pronounced downturns, and they are also pervasive, spreading across sector and the region. Just one of the early symptoms of a economic downturn is when various states start to see weaker positions-industry circumstances at the exact time.

I ordinarily observe how initial statements are behaving throughout the US — they are very near to levels that usually indicate a economic downturn is just about the corner. But the collection can be a tiny noisy.

So I took a glance at continuing promises by state, and this presents a much a lot more stable series. The image is unassailable. The percentage of states with continuing statements increasing much more 30% on an annual foundation has hardly ever achieved its recent level and not gone on to swiftly spike substantially better, and this has generally happened concurrent with a economic downturn.

This will come at the identical time as several other much less timely indicators have been highlighting economic downturn hazard is really substantial.

We’ll get a further examine on promises these days, with the change in seasonal elements final week making certain initial claims will continue to be elevated in comparison to their pre-adjustment values, while WARN notices have been pointing to elevated claims for some time.

Loading…

[ad_2]

Source website link