[ad_1]

Heading into Q1 earnings season which launched a little over a week ago when JPM reported blowout earnings and most banks reported results that came in better than expected, many Wall Street bears – Michael Wilson most notably – had staked their reputation that this earnings season would finally be the straw that breaks the market’s back and send stocks tumbling, eventually retesting their October lows.

However, as we noted last week, so far that has not been the case. Iin fact quite the opposite and while it was still early in the earnings season, last Tuesday we wrote that “Q1 Earnings Season Starts Off With A Bang… And The Best Beat Rate In Over 10 Years” thanks to 90% of companies beating on EPS, 73% on sales, and 67% on both, well above last quarter’s 54%/83%/46% post-Week 1 and historical average of 67%/64%/48%; this was the “best beat rate after Week 1 since at least 2012.“

To be sure, much of this was skewed by JPMorgan which benefited unduly from the collapse of small and regional banks, and it has still been very early on in the season.

If only looks at actual changes instead of expectations, Bloomberg Intelligence notes that, with 20% of the market cap reporting, the S&P 500 is on track for a year-over-year EPS decline of 7.3% vs. the pre-season forecast of -8.1%, and margins are largely as expected. Bank earnings avoided doomsday scenarios and it appears the industry turmoil has been largely contained.

So how are we doing one week later, and just ahead of the biggest and most important names reporting?

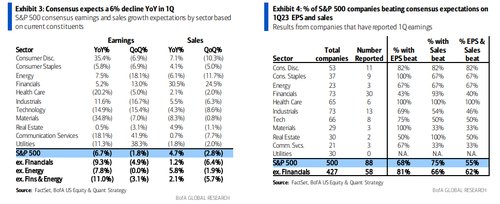

For the answer we go to the Week 2 edition of BofA’s Q1 Earnings Tracker (available to pro subscribers in the usual place) in which we find that with the second week of earnings behind us, 88 S&P 500 companies, accounting for 25% of S&P earnings, have reported.

The beat rate has predictably eased: 68% beat on EPS so far, down from a record 90% last week, but still above the historical post Week 2 avg. of 63%. A similar trend on the revenue side where 75% are beating on sales (vs. 59% historical avg.) and 55% beat on both sales and EPS (vs. 44% avg.).

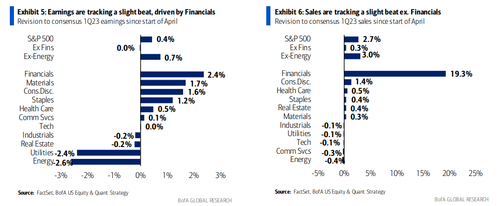

In total, Q1 EPS is tracking a slight beat of 0.4% vs. consensus, led by Financials (+2.4%); in-line with consensus ex-Financials.

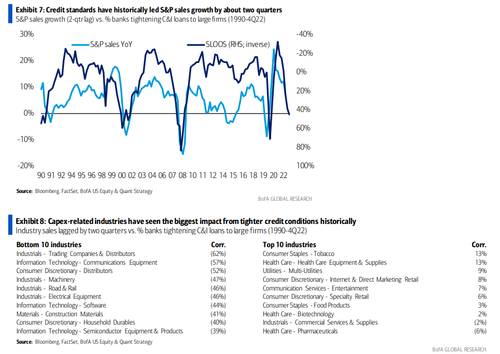

The lack of collapse in earnings is the good news. The bad news is that credit conditions have tightened sharply (as reported here, here and here) and will tighten more. According to BofA’s Savita Subramanian, historically credit conditions have led S&P sales growth by about two quarters, arguing for decelerating sales growth from here. Durable goods and capex beneficiaries have seen the biggest hit from tighter credit, whereas defensive and select retail sectors saw limited impact

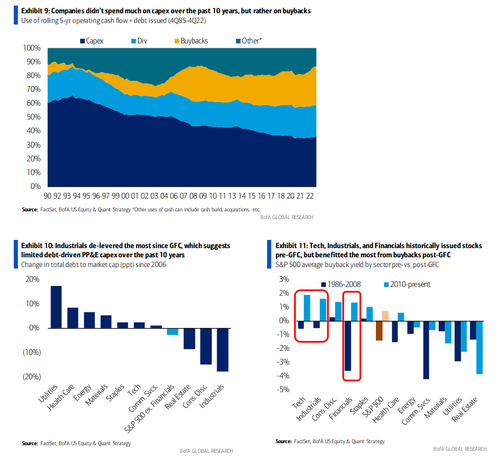

The silver lining is that this time may in fact be different: although capex beneficiaries have seen an outsized impact from tighter credit, today, capex sensitivity to constrained credit is likely lower for several reasons. Companies underspent on capex over the past 10 years relative to history. Since the GFC, for every dollar generated through operation or borrowed, 38c was spent on capex (vs. 52c pre-GFC), 21c on dividends (vs. 17c) and 24c on buybacks (vs. 13c). Second, companies shifted from spending on manufacturing and structures to spending on Tech over the last 20 years. Finally, Industrials spent most of the post-GFC period paying down debt, suggesting limited debt-driven PP&E investment. Fiscal stimulus, re-shoring and green goals are secular forces that could bolster capex in spite of cyclical headwinds.

While capex may be insulated, the rising credit risks are more acute for buybacks and Tech spend. The last decade of cheapening capital and falling hurdle rates incented companies to buy back shares. Historically, Tech, Industrials and Financials were net issuers of equity, but shifted to net buyers following the GFC.

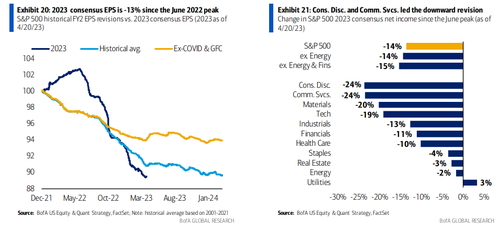

Going back to the core topic, namely the sharp outperformance of earnings relative to expectations, there is a reason for that: 2023 EPS have already been slashed -13% from the peak, and there is more to go. As Subramanian writes, 2023 consensus EPS has been cut 13% since June, tracking weaker than the historical revision trend. The trimming has been broad-based, led by Communication Services and Consumer Discretionary (-24% since the June peak), and BofA expects earnings to decelerate further and forecast $200 in EPS (-8% YoY vs. -20% on average in historical recessions).

What is notable is that during the prior four recessions (1990, 2001, 2007 and 2020), forward EPS estimates were revised down ~19% on average during recessions vs. just -2% heading into a recession. In other words, the bulk of the EPS forecast pain has already been experienced since not even the permabears can deny that the US is in a profit recession; the only debate is how deep it will be.

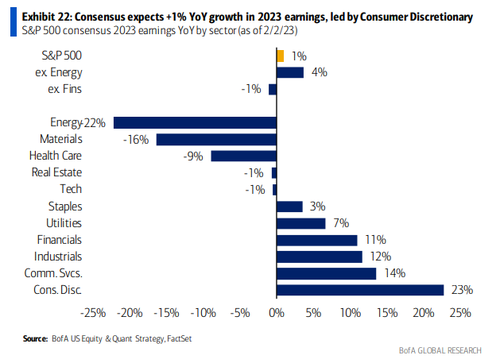

As an aside, consensus expects modest YoY EPS growth in full year 2023 earnings, led by last year’s laggards, Consumer Decretionary, while energy and materials – last year’s winners – are the two worst performing sectors.

Bloomberg chimes in here with a warning that future earnings are still steadily deteriorating. The S&P 500 is now projected to post four straight quarters of negative earnings growth. The 3Q EPS estimate decayed to a 0.2% contraction as of April 21, compared to 0.2% growth a week before and +4.6% at the start of the year. Estimates for 2Q23, 4Q23 and 1Q24 continue to be revised down — despite the 1Q beats. This implies the market is still cautious about the broader market backdrop.

Meanwhile, recession fears are likely starting to be factored into markets amid muted volatility. But investors don’t seem excited to buy stocks. A range-bound S&P 500 has sputtered after March’s rebound. Gains have been led by a few megacap tech stocks, with lofty valuations. With big tech companies starting to report this week, it will be easy for the market to be disappointed.

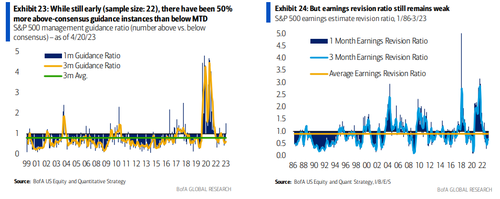

But while one can debate the accuracy of the perpetually-cheerful sellside, one thing which may stump the bear is that while still early, there have been 50% more above-consensus guidance instances than below so far in April. If the trend holds, this will mark the first month of above 1x in guidance ratio since September 2022. In other words, just like peak inflation is in the rearview mirror (at least until the launch of the next QE), so earnings are as low as they get.

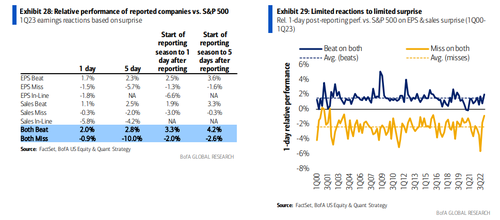

In any case, one doesn’t need to read the latest Fund Manager Survey to understand that the mood on Wall Street remains deep in the apocalyptic quadrant. That’s probably why when looking at stock reactions to earnings, beats see a pop, misses get a pass.

As BofA notes, with everyone cautious heading into this earnings season, companies that surprised to the upside were rewarded more than usual, outperforming the S&P 500 by 199bps the next day (vs. +149bps historical average). At the same time, companies that missed also got a free pass and only underperformed by 90bps the next day (vs. -238bps average).

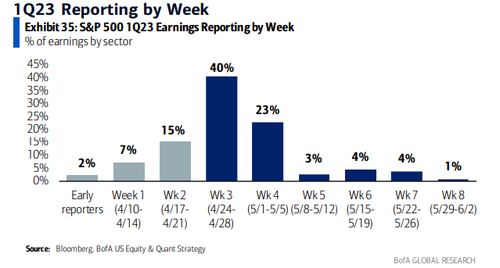

To be sure, a lot of the above is preliminary: after all, we only have just two weeks of data, but that changes quick as this week is the busiest week of this earnings season, with 40% of index earnings slated to report, including several mega caps.

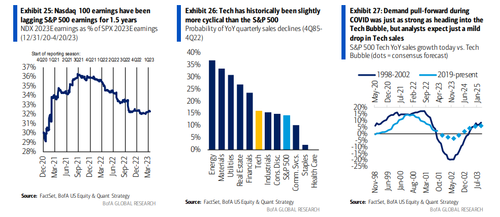

Given that the top 10 stocks drove ~80% of YTD returns for the S&P 500, the bar is high and the market is underestimating cyclicality of Tech. Some more on this key topic from BofA:

Investors cast Tech as being insulated from an economic downturn given its secular growth drivers. But for the past 1.5 years, consensus earnings for the Nasdaq 100 have lagged those of the S&P 500 (Exhibit 25). Historically, Tech has been more cyclical than the S&P 500 based on frequency of sales declines (Exhibit 26). A pull forward in demand during COVID and a potential reversal of globalization cost savings suggest Tech earnings may be both cyclically and secularly challenged. About 20% of IT spend is estimated to be derived from financial services companies, now under pressure to shore up capital. Moreover, the demand pull-forward amid COVID was at least as extreme as the Y2K demand pull-forward, after which Tech sales fell by 28% over the next six quarters. Today, analysts forecast a much shallower decline in sales from here through 2024 (Exhibit 27).

Additionally, 50%+ of Industrials earnings are also scheduled to report, where we expect to hear more about the cyclical impact from credit vs. secular tailwinds.

As noted earlier, here are the week’s most notable reporters: Comprising almost 14% of the S&P 500 by market cap, Microsoft and Alphabet tomorrow, Meta on Wednesday, and Amazon on Thursday will be among the most anticipated reports. The only one missing from the pack is Apple, which will report on May 4th. Other notable tech earnings this week include Texas Instruments (tomorrow), SK Hynix (Wednesday), Intel (Thursday) and Sony (Friday).

Investors will also be laser focused on First Republic which report today. After trading in a 120-150 range in the first 2 and a bit months of the year, they have been in a 12-15 range over the last month. So they haven’t broken back out of their depressed range but haven’t deteriorated further. So these results could be important to the company and wider sentiment as this has been the perceived next weakest link.

There are also some pharma heavyweights reporting, including Novartis (tomorrow), AstraZeneca and Sanofi (Thursday) in Europe. In the US, we’ll hear from Eli Lilly, AbbVie, Merck and Bristol-Myers Squibb (Thursday), among others.

Consumer demand will be gauged from an array of earnings from companies including McDonald’s, Chipotle, PepsiCo (Tuesday), Coca-Cola (today), Domino’s, Mondelez (Thursday) and Hilton (Wednesday). In autos, the focus will be on BYD (Thursday), Mercedes-Benz (Friday) and GM (Tuesday). Investors will be particularly interested in EV rollouts and pricing. Among other economically-sensitive bellwether stocks, industrials reporting include UPS, Raytheon, General Electric (Tuesday), Honeywell, Caterpillar, Northrop Grumman (Thursday) and Boeing (Wednesday).

Monday April 24

- Coca-Cola, Credit Suisse, First Republic Bank, Cadence Design Systems

Tuesday April 25

- Microsoft, Alphabet, Visa, PepsiCo, Novartis, McDonald’s, Danaher, UPS, Verizon, Texas Instruments, NextEra Energy, Raytheon, General Electric, UBS, Fiserv, Santander, 3M, General Motors, Chipotle, ADM, MSCI, Biogen, Dow Inc, Centene, Illumina, Enphase Energy, Halliburton, Spotify, First Quantum Minerals, Ares

Wednesday April 26

- Meta, Thermo Fisher Scientific, Ping An, Boeing, American Tower, Iberdrola, GSK, Boston Scientific, Vale, Pioneer, SK Hynix, Hess, Universal Music Group, Hilton, Deutsche Boerse, EQT, Roku

Thursday April 27

- Amazon, Mastercard, Eli Lilly, Merck, AbbVie, AstraZeneca, T-Mobile, Linde, Comcast, TotalEnergies, Bristol-Myers Squibb, Sanofi, Intel, Amgen, Honeywell, Caterpillar,Gilead Sciences, BYD, Mondelez, Northrop Grumman, Hershey, BASF, Keurig Dr Pepper, Valero, STMicroelectronics, Newmont, First Solar, Repsol, Activision Blizzard, Pinterest, Snap, Domino’s Pizza, American Airlines, Hasbro, Harley-Davidson, Hertz

Friday April 28

- Exxon Mobil, Chevron, PetroChina, China Construction Bank, Sony, Mercedes-Benz, Colgate-Palmolive, Eni, Neste Oyj, LyondellBasell, Norsk Hydro, Covestro

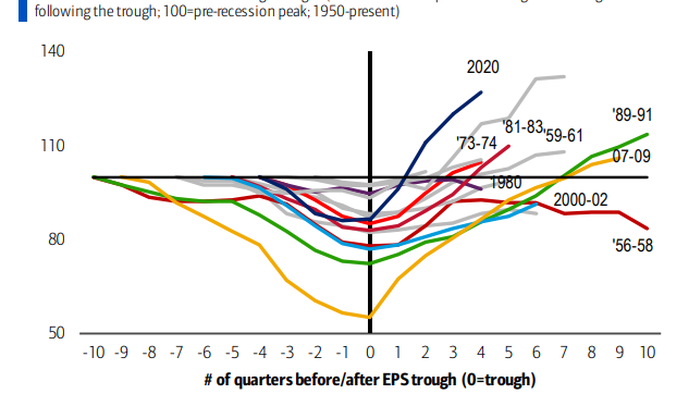

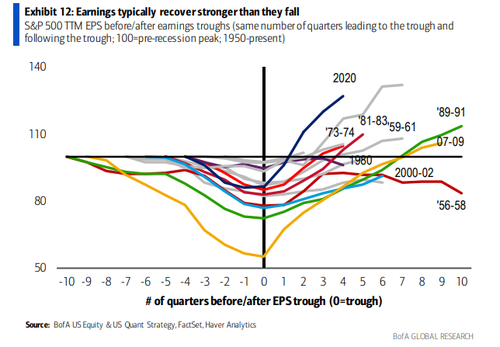

Looking further ahead, BofA expects earnings to outpace the economy in 2024, as the earnings downturn began earlier than the economic downturn this cycle. Earnings also tend to recover stronger than they fall, as downturns usually remove excess capacity, resulting in leaner cost structure and improved margin profiles.

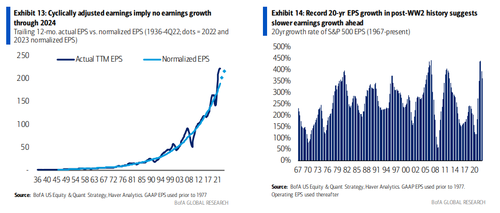

That’s the good news: the bad news is that actual earnings vs. cyclically adjusted earnings argue for no growth for the next two years

Therefore, according to BofA, a recovery back to 2022 EPS of $218 as a good starting point for 2024 estimates. But the bank cautions that its normalized earnings estimate assume that the more sticky tailwinds from the last 20 years (globalization, lower taxes and import costs and labor) continue rather than reverse, and many adverse factors (national security risks, geopolitical risks, rate risk and supply chain shifts) argue for a meaningful reversal.

Much more in the full note available to pro subs.

Loading…

[ad_2]

Source link