[ad_1]

Authored by Simon White, Bloomberg macro strategist,

The Federal Reserve’s following transfer right after an predicted pause is additional probably to be a minimize than a hike owing to previously restrictive fees, falling inflation and a recessionary economic system.

Pause talk is in the air – with the current market pricing in only a ~30% likelihood of a price rise at future week’s Fed meeting – prior to further more hikes. But the entire world, and the Fed, could appear sufficiently diverse even by late summer season that the chance calculus commences to favor looser financial coverage.

There are 3 key aspects that could alter the Fed’s determination-generating framework and prompt it to stage again from its hiking cycle following a hiatus:

-

The Fed really almost never raises charges once again right after pausing when plan is now restrictive

-

Inflation will preserve falling in the coming months, when labor-price pressures are being revised substantially decreased

-

The positions market place is weakening rapid

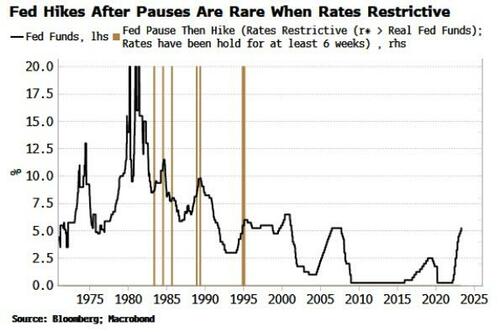

It could possibly be a shock, but it’s unusual in truth for the Fed to re-tighten policy soon after pausing. It is even rarer for it to do so when fees are currently restrictive.

What’s more, as the chart underneath displays, the scenarios of this in the early 80s happened when rates have been in a for a longer time-term downtrend, in contrast to nowadays. It would so be almost unparalleled (albeit not unattainable) for the Fed to increase fees all over again following pausing.

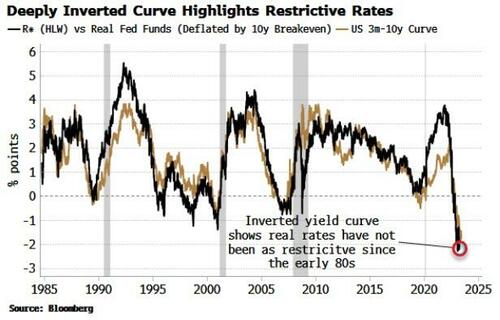

By quite a few actions, charges are presently really restrictive. Serious coverage charges are about to be previously mentioned r*, the estimate of neutral. It is an imperfect measurement with several assumptions. But inflation-repairing swaps see the authentic Fed fee at 2%-2.5% as a result of summer, effectively more than enough previously mentioned the most up-to-date r* estimate of about .6% to reveal policy is indeed restrictive.

This is underscored by the yield curve’s inversion, which is giving us a clear read through on how restrictive prices are. The 3m-10y curve is nearly a facsimile of the degree of restriction in the true plan amount.

It is no surprise some banking institutions went underneath. The greatly inverted curve is a barometer of level pressure making up in the system, and a reminder that other unpredicted grenades could go off and upend the Fed’s present-day outlook.

The inflation backdrop will also appear quite distinctive in the coming months, with headline CPI set to slide to close to 3%, in accordance to fixing swaps. Main CPI ought to also preserve slipping for now, based mostly on top indicators.

The Fed is focused on wage development for inflationary signs. But real wages are possibly still unfavorable or scarcely optimistic, based on what evaluate of compensation you use.

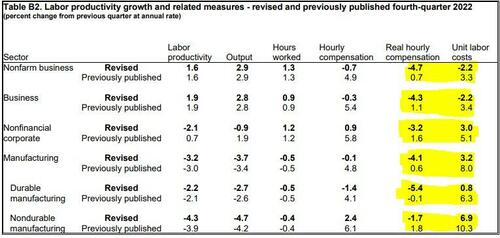

Moreover, wage pressures are not practically as large as they were being considered to be. Previous week’s launch of work information observed considerable downward revisions to true hourly compensation and device labor expenses for the previous quarter of 2022, as found in the last two columns in the desk down below.

Resource: BLS

The positions scenario may well glance incredibly different before long also. Bear in mind that unemployment is a person of the most lagging indicators. Normally, the labor market seems in affordable form when a economic downturn is previously underway. It’s also not unusual to see some unexpectedly large payrolls figures at this time (even if they could nicely be subsequently revised significantly reduce).

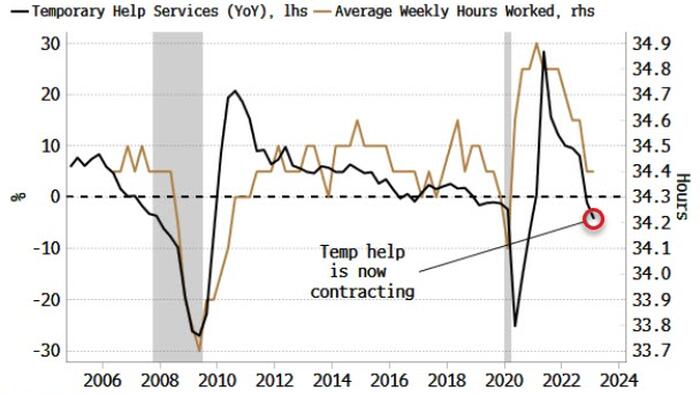

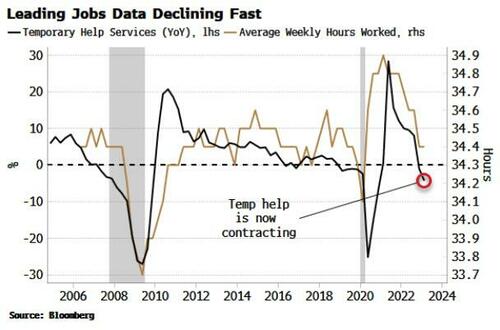

It’s prudent as an alternative to concentrate on the most forward-searching work indicators. Two of these are momentary assist and normal weekly hours worked. Companies are most likely to cull temp staff and minimize entire-time employees’ hours before they move to sacking individuals. This is also why extra lagging steps of employment are likely to keep up right up until just after the recession has begun.

The two temp help and hours labored are falling rapidly. The work opportunities problem – and for that reason the Fed’s hazard-reward for hiking prices again – could look sizably distinctive in the coming months, particularly as a in the vicinity of-phrase economic downturn looks exceedingly probable.

The megacap-styled elephant in the area is the inventory industry. Can the Fed minimize fees when there is a veritable buying frenzy in a couple corners of the market?

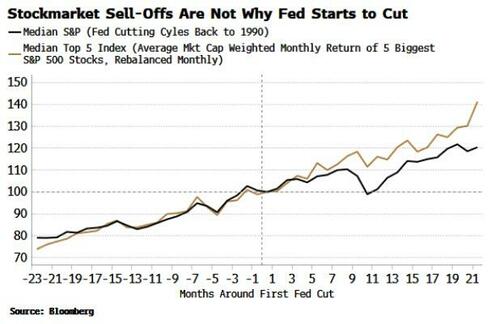

You could hope the sector to bounces the Fed into a rate slash by promoting off first. But that is not what has transpired on ordinary around the past 30 yrs. As the chart beneath reveals, the S&P tends to rally into the first Fed reduce of the cycle.

What’s more, the chart also reveals this is the exact for the most significant shares, which are driving today’s market place larger. The Major 5 Index rallies into the first amount cut and continues to do so afterward.

Canada and Australia’s the latest price hikes are including a dose of uncertainty to the Fed’s outlook. This could insert much more volatility to expected plan somewhat than plan alone.

Even so, the Fed will have an increasing number of off-ramps enabling it to chorus from additional hikes. And the more time it does so, the much more the backdrop will favor plan loosening. The pause that refreshes could conclusion up being the prelude to a cut.

Loading…

[ad_2]

Supply website link