[ad_1]

‘Good’ headline macro news (sturdy ADP and ISM Expert services defeat) was to some degree trumped by ‘bad’ macro information (inflationary pressures re-accelerating less than the hood)… all of which do very little at all to help The Fed’s ‘easing’ at any time before long (solid employment and resurgent inflation).

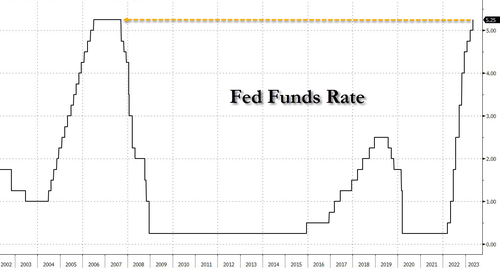

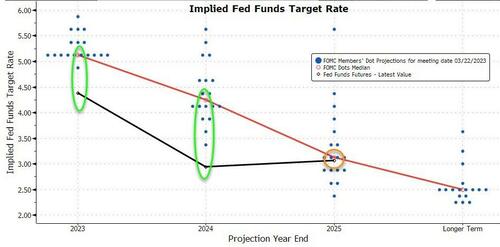

Of system, currently was all about Powell and his buddies who signaled a ‘hawkish pause’ (despite the market’s extremely dovish beliefs). June level-hike odds rose…

Resource: Bloomberg

Now it gets intriguing…

Resource: Bloomberg

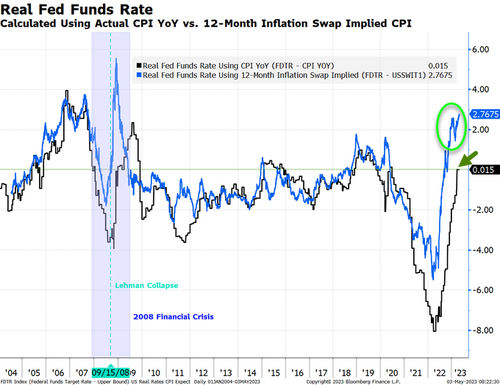

With Serious Rates good for the first time because 2019…

Source: Bloomberg

Powell’s feedback did almost nothing at all to assistance (unusually):

-

POWELL: SENIOR Bank loan Study Constant WITH OTHER Details

-

POWELL: Quite possibly AT Adequately RESTRICTIVE Degree, Might NOT BE Considerably OFF

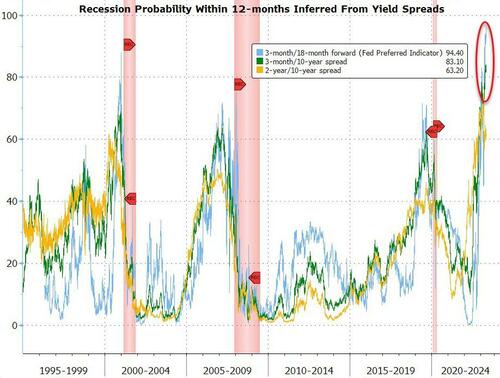

A recession is coming but really don’t be expecting level-cuts…

Yield curve provides 94% odds of a economic downturn within just 12 months…

Really don’t feel the market’s dovish buzz!

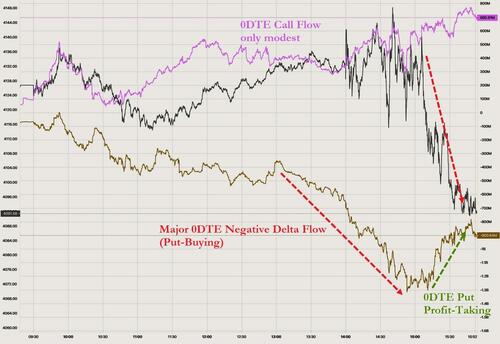

And that spooked shares reduce (not assisted by Powell’s hints at how terrible future week’s SLOOS info will be). Small Caps managed to keep on to gains but the S&P, Dow, and Nasdaq tumbled…

0DTE traders have been betting on the downside in a significant way right now and took gains following the put up-Powell puke…

Massive reversal in “most shorted” stocks nowadays (which aids describe the early gains in Little Caps)…

Supply: Bloomberg

Regional banking companies puked just after Powell claimed the banking process was sound and resilient…

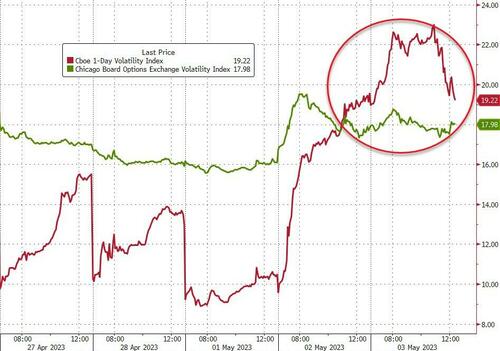

VIX1D stays notably higher than VIX…

Resource: Bloomberg

Treasury yields tumbled at the time once more now with the tummy of the curve outperforming (5Y -11bps, 30Y -2bps). It really is been very a 7 days in bonds already…

Resource: Bloomberg

The 2Y prolonged down below 4.00%

Resource: Bloomberg

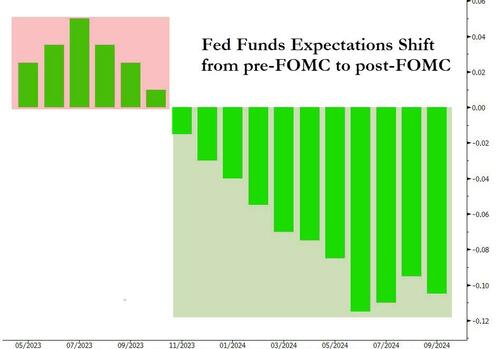

The STIRs curve adjusted (modest) hawkishly in the shortest conclude but notably more dovish up coming 12 months on…

Source: Bloomberg

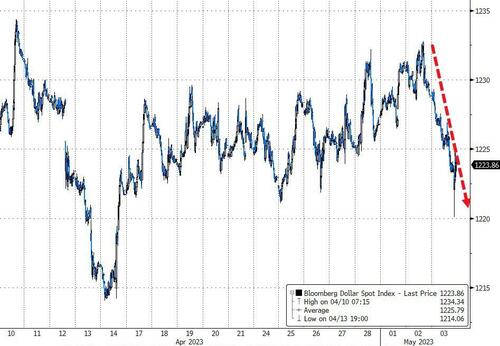

The Dollar dived on the working day to two-7 days lows…

Resource: Bloomberg

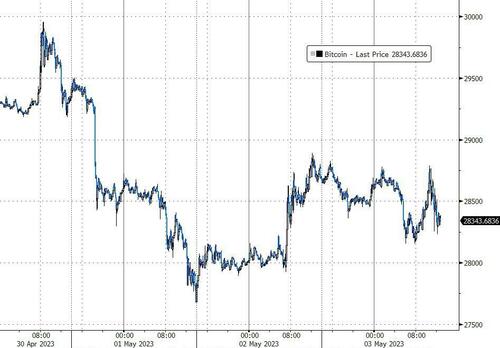

Bitcoin chopped about but finished marginally lower…

Resource: Bloomberg

Gold rallied on the working day (marginally)…

But crude was clubbed like a little one seal with WTI tumbling to a $67 manage intraday, considerably underneath the pre-OPEC+ degree…

Ultimately, the market remains considerably extra dovish than The Fed and Powell throughly turned down that look at right now…

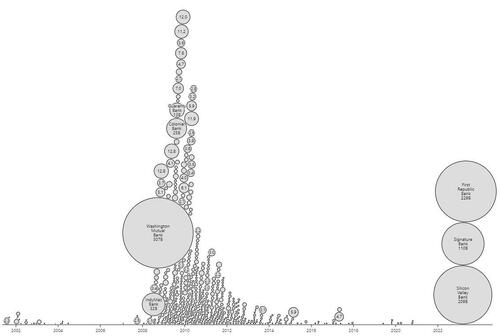

And WTF is Powell conversing about boasting that the banking process is sound and resilient and is stabilizing…

POWELL: 3 Massive Financial institutions Were AT Coronary heart OF EARLY-MARCH Tension, NOW ALL Solved pic.twitter.com/1BQikU8iCy

— Newsquawk (@Newsquawk) May perhaps 3, 2023

2023 lender failures are now larger than 2008 and 2009 mixed…

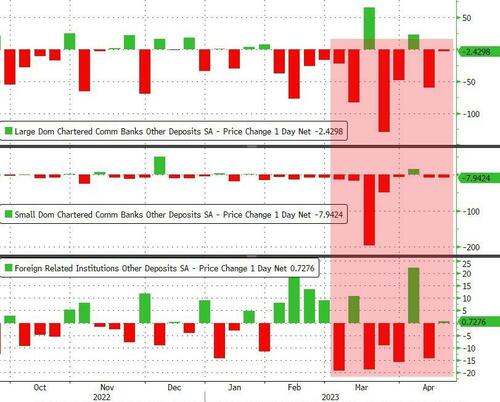

And deposit outflows continue from substantial and small banking institutions…

Sorry Joe ol’ pal, jawboning’s not gonna out more than enough lipstick on this pig to correct this shitshow…

It is on you mate! The industry is demanding cuts (and pricing them in) and you just produced it even worse.

Jeff Gundlach will get the final word: “…markets for possibility property are also complacent.”

Loading…

[ad_2]

Supply backlink